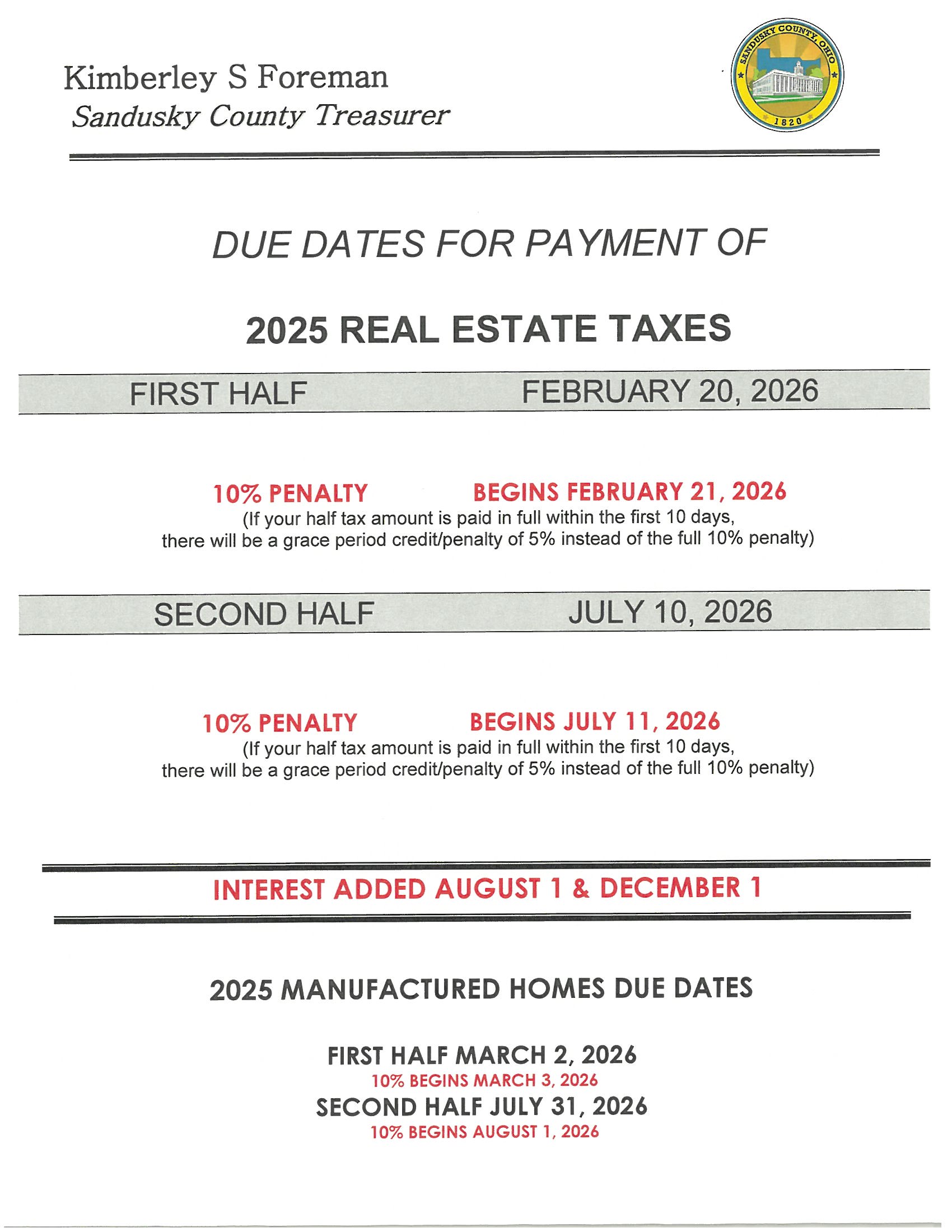

Sandusky County Treasurer

For more information please visit: www.sanduskycountytreasurer.us

____________________________________________

Duties & Responsibilities of the Sandusky County Treasurer:

The Sandusky County Treasurer serves as Sandusky County's chief investment officer, the administrator of delinquent tax collections and the keeper of the property tax escrow account. The Treasurer serves as the county banker, safe keeper of all taxes and investor of local funds.

Address: 100 N. Park Ave. Suite 112, Fremont, Ohio 43420

Telephone: (419) 334-6234

Fax: (419) 334-6235

Office Hours: 8:00AM to 4:30PM, Monday through Friday. Open during lunch hours.

Elected Official: Kimberley Foreman